Basics of Investing

This section is prepared for those who want to get a better understanding of investing, have an RRSP account, plan to open one in the future or for people who are a part of group pension plan at their place of employment. It will also help people who simply invest part of their disposable income. The author of this article has tried to simply present important aspects and maximum information necessary to make an investment decision. It is essential for every investor to understand basic principles of investing. The rules, shown below, will always remain the same regardless of where you invest your money – through investment, insurance company or bank.

There are two different types of investment in Canada: active and passive.

Active investment – when you or a broker performs the purchase of stocks from stock exchange. For most investors this is not a good option. It requires a thorough knowledge and a constant observation of the market. That is hard to do when you have a regular full time job and other responsibilities.

On top of that, sometimes, your broker will not be performing in the best of your interest. That is because his/her commissions come directly from the process of buying and selling. This means that your investment portfolio will always be in action of buying and selling, but there is no guarantee that your broker, even a very experienced one, will know exactly when it is a good time to sell and/or buy. Nobody can predict the future.

That is why most people prefer the second option – passive investment. What does that mean – passive investing? It is investing performed through investment funds – segregated funds.

Why investment through segregated fund will be beneficial to you?

- Level of Professionalism: You do what you are good at, while a team of professionals deals with your investment. It’s a team because, if you are dealing with a big, world known firm, such as Manulife, Canada Life, Industrial Alliance, Etc., then you are looking at a large amount of professionals. It could be hundreds of people, located in different parts of the world, working on behalf of one investment fund and their objective is to increase our capital.

- Suitable for any level of income. You can invest as little as $25 per month or make a one-time investment of $500 or $1,000.

- Risk Management: The risk of losing your investment is a lot lower compared to you making your own investments into the market. Why? Because, individually you can only purchase stocks of a few companies. Your expectations are to see an increase in the value of these stocks. If even one of these companies isn’t performing well, you lose money. Imagine that you put your money into segregated fund that has a large amount of investors like yourself – millions and millions. Risk becomes substantially lower, because with this money it is possible to purchase stocks of two, three or four hundred companies. Problems in some of these companies will not have much of an effect on your savings.

- Liquidation: segregated fund is required to accept your stocks and exchange them for cash at any time, as you wish.

- An ability to transfer your money from one fund into another inside the insurance company.

- Investor Protection. Investments go into funds that are protected in a few different ways:

- The money you invest is kept separately from managers’ assets and nobody has an ability to spend the money on another purpose.

- All assets are kept in major banks and are protected by “Canadian Banking” and “Trust Legislation”. In other words these assets are even separated from banks assets.

- Every fund has an independent auditor who reports to board of directors according to government rules and regulations.

- In some provinces there is extra protection for investors in case of bankruptcy of an investment fund. In Ontario this includes “Provincially operated Contingency Funds”, which is meant for an unexpected occurrence.

Now we have to understand what types of segregated funds exist or where segregated fund managers can invest your money.

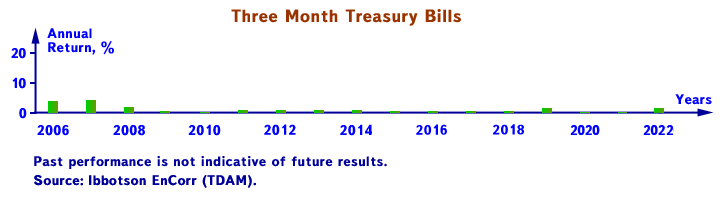

- It can be Money Market segregated fund. Managers of this fund invest money in to the government papers, issued for a short term (less than a year). For example, 3-months Treasury Bills. They never lose value. The gain was different from year to year, but not less than 0%. It is risk free, like a saving’s account. You can’t predict what interest will be each year. At this point of time it is about 0%.

*This graph was created using the annual return from PALTrak (Morningstar).

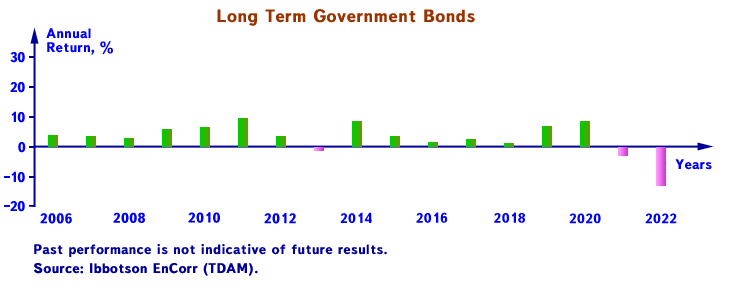

2. Bond segregated fund. Managers of this fund invest money in to the government papers issued for a long term – 10, 15, 20 years (long term government bonds). The Bond segregated funds are almost guaranteed investment because of the nature where they invest money, but even there we have slight possibilities to have negative return per year. However, when they gain, they gain more than short-term papers.

*This graph was created using the annual return from PALTrak (Morningstar).

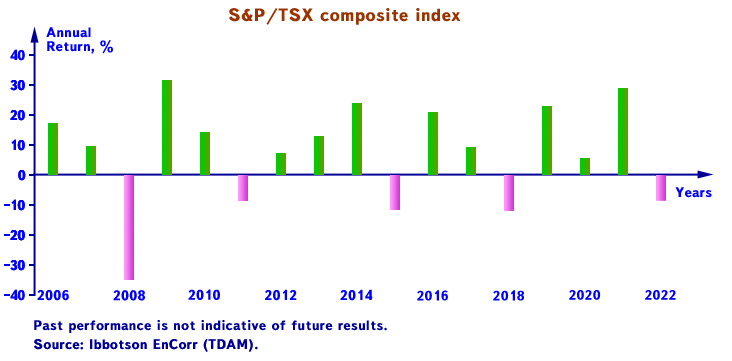

3. Equity segregated Fund. Managers of this fund invest money in to the stock market. Money used to purchase shares of 100, 200 or 300 companies, hoping that the value of these companies will increase in the future, accordingly, value of the segregated fund will also increase and everybody wins. Below you can see the picture with S&P/TSX composite index. This index could be compared with the regular segregated fund, holding in its portfolio only stocks of hundreds different companies. Potentially the investor can gain more here for a long period, compare with the funds, working only with bonds, but the risk is increasing significantly in the equity funds.

*This graph was created using the annual return from PALTrak (Morningstar).

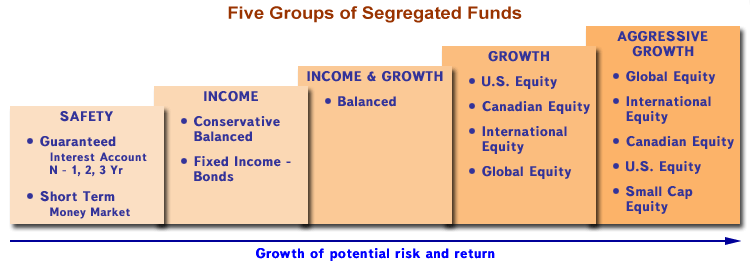

We have outlined three investing techniques used by segregated funds: short term government papers, long term government bonds and company stocks. Based on this you can break most of Canadian based segregated funds into 5 groups.

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company.

1st group – Safety – funds that only work with short term government papers. These are reliable, guaranteed and risk free, with a steady relatively low returns. Today, the rate is around 2%.

2nd group – Income – these funds work with long term bonds. There are other funds of this kind, like Mortgage Funds, Dividend Funds.

3rd group – Income and Growth – these are funds that balance their purchases between bonds and company stocks. The ratio between the two varies. Some funds use 70% and 30%, some 50% and 50%, others 30% and 70%.

4th group – Growth – segregated funds that work with companies stocks. Companies have no specifications, they could be American, Canadian or any other foreign company. General principal remains: stock purchase is accompanied by risk.

5th group – Aggressive Growth – these are aggressive funds that focus on one market (for example, Asian) or narrow their investments to a certain sector of the economy, like raw materials and high-tech industries. There are possible high returns as well as big losses.

This break down of segregated funds into 5 groups is genuine for all funds because these groups are general. They show the relation between profit and the risk, regardless of how you will be presented with them: through insurance company, bank, or at work (where you will have to choose one of the options for your group investment plan). All funds that exist, whether in Canada, US, or anywhere else in the world can be broken down into these 5 groups. There are different branches that can usually be identified by their name. If the name includes words like “Money Market” or “Short Term Investment”, they belong to the 1st group. If the name includes “Bond” or “Global Bond” or “Canadian Bond”, they belong to the 2nd group, which gives you more profit with an extra risk to it. If the name includes words such as “equity”, “aggressive”, “global”, “international”, then these are the funds that work with stocks (Equity Funds). If it is a fund that has it balanced its name will say so – “Balanced Funds”.

The question is which fund should you chose. This is a very serious decision and it is best that you understand that the longer you invest the more risk you are allowed to take. On the contrary, if the fund withdrawal time is close, less aggressive your investments should be. Of course, there are other things you will take into consideration. Economy experiences its ups and downs, sometimes quite noticeable. When that happens you want to feel comfortable about your investment. Financial advisor should discuss each situation and make individual recommendations using special tests. You can see which group of segregated funds you might chose using this test.

When planning long-term investment, you should always include segregated funds that use stock market. The younger you are the more aggressive you can be. Since nobody can predict future market trends, it is important to invest on regular basis.

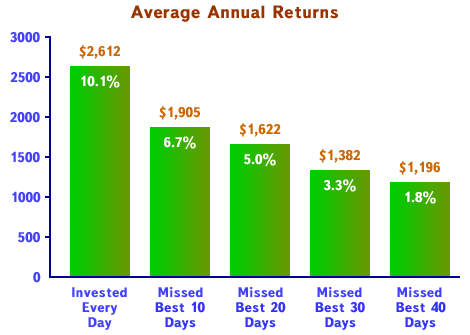

Here, you can see how constant investing effects your potential returns.

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company and William M. Mercer Limited Benefits Canada, September 1997.

If a $1,000 is invested in TSE-300 and is left there for 10 years, then average annual return will be about 10%, so $1,000 will turn into $2,612. If in that 10 years you skip 10 days with highest growth, then potential annual return will only be about 6.7% and you will receive $700 less.

Since it is impossible to predict when market will have its best days the right decision is to invest on regular basis (every month, for example).

INVESTMENT WITH THE GROWING MARKET

| This table shows an example of monthly investments of $200 into a fund that is increasing in value. Since the price per unit has grown from $10 to $15, the fund makes 50% profit per year. That is good. Since the price per unit keeps growing the same investment allowed us to buy less units every month. In the end, 190.9 units purchased in a one-year period brought a profit of 19.3%. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company.

INVESTMENT WITH THE FLUCTUATING MARKET

| Now, let’s see how the same investment works in a slightly different fund. This fund did not increase in value, hence 0% profit. On the contrary, half way through the year price of the unit was 50% lower then the initial value. At this time, since the investments were made every month, same $200 has bought bigger number of units. Towards the end of the year, when the unit price bounces back to its initial value, the number of units purchased has increased to 293. Simple calculation shows that with this fund total return was 22%, which is even better than the previous one. This strategy is called “Dollar Cost Averaging”. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company.

Since the unit price always changes it is impossible for us to predict best and worse days. Changes will always exist. With monthly investments your investments hit both, good and bad days, which averages out to a good result.

Of course, there are different situations, but I want you to understand that monthly investments are not only easier (its easier to invest smaller amounts every month then a large sum at the end of the year), and it can also give you a better final result.

I am sure you know this situation – January, February come, it is time to pay taxes and the people would like to reduce it using the official way. The best way to do so is to make payments in to RRSP but the person doesn’t have money available for this contribution at this time, for example. Of course, RRSP loan can be taken with very low interest but it is a big one-time deposit in to the market. Some tax payer deposit $10,000, somebody just $1,000 or $5,000 and the problem is that no one can say at what point of investment cycle the money is invested – is it good time to invest in to the market or not. Everyone understands – buy stocks when it is cheap, sell when it is expensive. So to say for sure what day this will be – good or not is practically impossible. But there is not much choice. We have to invest money today because it’s February, last opportunity to invest into an RRSP and reduce taxes for previous year. Paying off this loan during the year is like investing monthly but it’s a little different. The money is invested in February, one-time payment, and the debt for that is returned throughout the year. There is a risk – at what stage of the cycle have you invested your money in February. Specialists recommend – instead of taking the loan and paying this loan back during the year, try to make the same monthly contributions in to RRSP account during the year (almost the same payments like returning RRSP loan during the year). In this case you will deposit the same amount, whatever you decide, but it will be monthly contributions in to the market instead of jump to market and taking the risk of investing not at the right time of market cycle.

When investing there is a certain risk:

- Company is not doing so well this quarter – this effects stock value (business risk).

- Depending on stock demand the value may increase or decrease (market risk).

- Profitability of government bonds (long term and short term) depends on the prime rate (interest-rate risk).

- With the long term government bonds, bringing certain profit every year, there is a risk – at what current market rate will this profit be invested (reinvestment risk).

- Inflation risk. There is a chance that inflation will overcome your annual profit when investing into guaranteed low return funds (purchasing power risk).

- Investing internationally creates risk associated with currency exchange rate (currency risk).

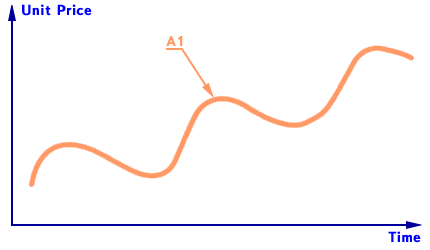

With so many different kinds of risk even large segregated funds with large team of professionals can’t always guarantee a constant rise in unit price. Let’s look at strategy called “Asset Allocation”. The price per unit experiences its ups and downs

Pic. 1 |

Pic. 2 |

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company.

Let’s also visualize clock (Pic. 2).

Considering that unit price goes up and down, top point (12 o’clock) – fund’s unit price is at its highest, bottom point (6 o’clock) – fund’s unit price at its lowest. Unit price changes. Everybody knows that buying should be done at lowest price (6 o’clock) and selling at the highest price (12 o’clock). Every segregated fund has its own cycle. Funds that work with different style of operations and under different conditions has the same cycle of unit price, shifted in time. Unit value in one fund can be at the bottom of the cycle (6), another funds unit value could be at the top of the cycle (12), while third and fourth could be at 9 and 3.

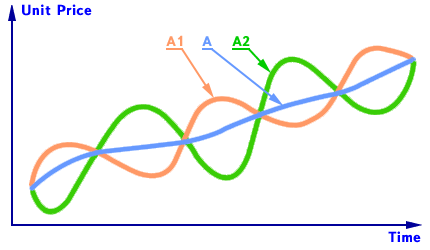

Keep in mind that no fund can really identify at what point of the cycle their unit value is. For that future has to be predicted. Taking this in consideration investor might consider to change fund because currently owned unit price could be at its bottom point 6, but there is no guarantee that next fund you invest in won’t be at 6 as well. It could also be that you invest at 12 and still lose. If the investor stays with the same fund, stocks will go back up, you may even profit more if you invest on regular basis (Pic. 3).

Pic. 3

*This graph was created using brochure “Knowledge is Power” from Clarica Insurance company.

Financial advisor’s job is to pick segregated funds that are moving in different directions to balance out the changes appropriate to any fund.

This way investor’s portfolio will be less active, which brings fewer worries to the investor.

Still, corrections are necessary from time to time. This requires help of financial consultant. I invite you for an individual discussion of your future plans about an extra income during your pension. Investment program can be started with any monthly investments (as low as $25).