Life Insurance

Life Insurance is very significant for every family.

Life Insurance Programs can be of different kinds:

- Individual Life Insurance, which you buy directly from the Insurance Company;

- Group Insurance, which the businesses buy for their employees from Insurance Companies. See section (Work Benefits);

- Accidental Life Insurance. The sum insured is paid only in case of death as the result of an accident.

All individual Insurance Programs can be subdivided in two categories – Term and Permanent Insurance. To be able to understand the difference, let us first imagine temporary and permanent residence. Temporary residence means renting an apartment. We need a place to live (roof over your head) – we pay for this kind of apartment. If we need it for 5 years, we pay for 5 years. If the rent goes up – we pay. If we do not need this apartment any more, we do not pay for it. We can move out of the apartment at any time, but we will never be able to get back the money we have paid for it. If we do not pay rent for one month, we have to move out. Everyone knows the difference between paying for rented apartment and for private home. One pays more for private home because of the mortgage. But it is possible to sell your home at any time and get some money.

The later you sell, the more money you have. After the mortgage is paid off, the property is ours.

The same is true for insurance programs. Permanent Insurance covers your permanent insurance needs. Term insurance covers yours temporary needs, costs less than Permanent Insurance and provides comprehensive coverage. That is the advantage.

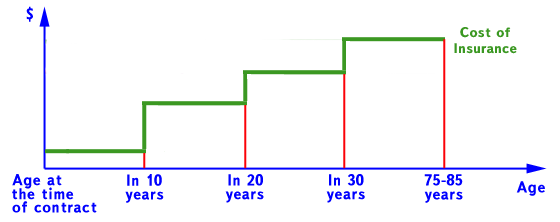

The shortcoming of Term Insurance is that your monthly payments will grow in time and that the Insurance stops at certain age. Usually it happens at 75. Some companies offer it till 85.

Let us look at the example of a man of 40 years old. He has Life Insurance for $200,000. For today his monthly payment will be $22. In 10 years he will pay $105, ten years later – $251, then $625, and the last payments will be $1,523 per month. Of course, nobody is going to pay such big sum of money to the Insurance Company! The payment is estimated for a person, whose health has not become worse, but there is no way of making the same contract with a more acceptable price. But if 10 years later the person signs a new Insurance Contract and answers all medical questions all over again, his or her monthly payments will make not $105, but $42. Insurance Companies make conditions for Term Insurance in such a way, that 10 years later the client will break the contract and all the money will be left for the Company. If the person is healthy, he will sign a new contract. If he is not healthy, he will keep the old contract and will pay the amount demanded by the Insurance Company (which is also beneficial for the Company); or he will change for Permanent Insurance, where prices do not grow.

When buying Term Insurance, people compare prices they pay for the same cover (for example, $200,000).

I will do my best to explain to you these two kinds of Insurance Programs. Term Insurance will become more expensive in time. It is essential that the period of time does not change; say, it equals to 10 years. The Insurance Period should last till certain age (75-85 years old), but not for the nearest 10-20 years, and it should be stated in the contract, that before the age of 65 the client has the right to change for Permanent Insurance without answering medical questions (conversion period). If there is no indication in the contract that the client can change for Permanent Insurance, monthly payment will be a little lower. But this is a very important condition. If we choose Term Insurance and state the right to change for Permanent Insurance in future, it is important for the company to be able to offer a certain variety of Permanent Insurance Programs and good prices. It is possible to get all these at a big Insurance Company, which is well-established in the market of both “Term Insurance Programs” and “Permanent Insurance”. This factor plays important role in choosing an Insurance Company.

The wording Permanent Insurance Program speaks for itself. It works for a long period of time. At present moment it costs more than Term Insurance, but its price does not grow. It is not limited by the age. As long as you live, this insurance works. It means, that the Amount Insured will be paid in future unconditionally, because the cause of death is not indicated in the contract. When death takes place – the sum is paid.

So, the monthly payments in Permanent Insurance are higher. The Insurance Company receives money, part of the interest in form of dividends deposits the money into account within the Insurance Contract; it means, that money accumulates every year while Insurance works. For convenience this money can be called Reserve Fund. Because these are dividends, in the beginning the accumulation is not large. In years the money grows quicker, because the interest made within the Insurance Program is not taxed. At any moment of time, if the client decides, that he does not want to continue the insurance, he gets the whole Reserve back. As a rule, in 15 to 20 years this amount equals to total sum you have paid for your Insurance. In other words, if you cancel the Insurance contract in many years, you get your money back. It should be mentioned that the interest you made is taxed at the moment of withdrawing the money. This is the way Permanent Insurance works. We pay more, than necessary; the Company works with our money and shares the interest with us.

There is another type of Permanent Insurance. It is called Universal Insurance. Universal Insurance is another kind of Permanent Insurance, which has no age limitations and has accumulations. There are no dividends in Universal Insurance. There is a principle at work here: Buy Term – Invest Difference. Part of your monthly payments is used to pay the Insurance (the insurance risk), and the rest of the money goes to build the Reserve Fund. Our Reserve Fund works in the market and brings interest every day; the interest is not taxed. The cost of Insurance for the Company can be seen in Universal Insurance, which is a kind of regular Term Insurance. The type of Universal Insurance is determined by the kind of Term Insurance indicated in the contract.

There are two kinds of Universal Insurance.

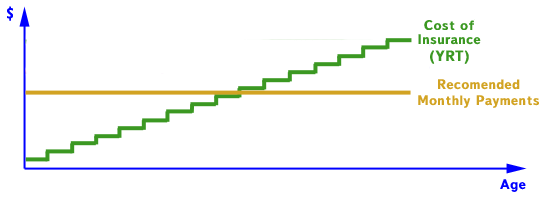

In the first kind the Cost of Insurance is charged in the form of Term Insurance, the price for which is going to grow every year (YRT- Yearly Renewable Term) or in “steps” in future.

The second kind of insurance shows Term Insurance for the period of time up to 100 years (T-100), the cost of this kind of Insurance is determined at the moment of signing the contract; it does not change in course of time.

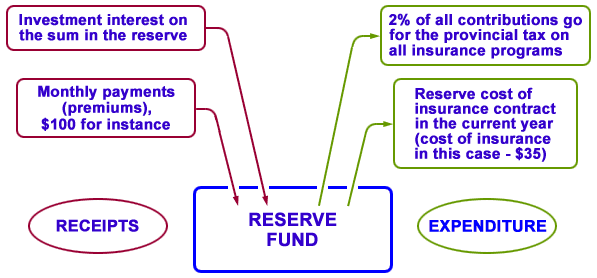

In the first kind of Universal Insurance the Reserve Fund will grow the following way: monthly payments (say, $100) minus the cost for insurance ($35), minus 2% of tax, which is working in all kinds of insurance, plus interest, which adds every day.

As a result, the reserve money accumulates in a special account. Regrettably, the cost of temporary insurance (YRT) goes up every year, becomes very high when you retire, and starts exceeding monthly payments. The difference between monthly payments and the increased cost of insurance is covered out of the accumulated Reserve Fund. The reserve accumulates as follows: monthly payments ($100 for instance) minus the cost of insurance in the amount of $35 and minus 2% of state tax, which is payable on all insurance policies; plus interest on the money on the account.

If we take as an example a man of 40 years old who has Insurance Contract for $100,000 and the Reserve Fund interest rate is 8%; the Recommended Monthly Payments will be $65. At the age of 65 the man will have Reserve Fund of $33,000 (though if fact he will have paid only $19,500). The sum of $33,000 will be used in future to cover the growing cost of Insurance. If we suppose, that the interest rate is 10%, then the Recommended Monthly Payment will be $53. If the interest rate is 6%, then Recommended Monthly Payment will be $93. What happens, if we calculate monthly payment at 10% rate and come up with $53, but in reality the Reserve Fund will grow at 6%? In this case the Fund will not be sufficient and the Insurance contract will break automatically at retirement age. That is why it is important to use realistic interest rate to calculate Recommended Monthly Payments.

Question may arise: Why do we need a Reserve Fund at all? Let us look at the following situation: a man has Term Insurance for 7 years. He pays $35 per month. He went for vacations for 3 weeks (to visit his family in Russia) and had to stay there 1-2 weeks longer because of illness. At this very time the Insurance Company is withdrawing his usual monthly payment. It happened so, that something was wrong with the account and the Insurance Company did not get any money. It mails a letter to the client, informing him that it is important to cover monthly payment of $35 during 30 days. Because the person is absent and does not get the letter, the money is not paid. The Insurance lapses automatically. If the person needs Insurance, it can be reinstate within 2 years, but the client will have to pass medical tests.

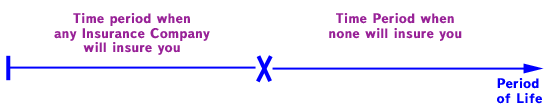

What is the advantage of Insurance Contract? The client must show that he is in good health only once at the moment of signing the Insurance agreement. All further changes in the client’s health do not affect the contract. When the contract is automatically lapsed the client must show at renewal that he is in good health. If he is unable to do so, he cannot reinstate the old Insurance and cannot get a new one. There is a certain point of life before which any Insurance Company offers to insure the client. But after this time none will insure you.

None wants to risk. The point of life you see above is individual, for some people it will be 30 years old, for others – 55, and for someone it may be 70 years old. We come to Canada recently, that is why we have insurance advantage over those, who have lived here long. Medical history in Canada counts like credit history and Canadian Experience. And if we do our best to get Canadian Experience and Credit History, Medical History will manifest itself without our desire. Immigrants, who came to Canada long ago, defined their family doctors and have learned everything about their weak spots. Newcomers do not know what is happening with their health, because they went to the doctor in the former USSR only if they were sick. In this country annual health check-up are compulsory and in fact, it is very important. This way our Medical History is built.

Reserve Fund is included in almost any Permanent Insurance. It helps to cover monthly payments when a client cannot pay or does not want to pay for Insurance. As long as there is money in the Reserve Fund, monthly payments will be covered. In the situation with going for vacations and getting sick, the Permanent Insurance will not be stopped.

Here is another situation. A person leaves his job and does not work for 4 months while looking for another job. He can call his Insurance Company and stop payment for a while. This is universal for Permanent and Universal Insurance.

If the wording in our Universal Insurance says: “Cost of Insurance – Guaranteed Level,” it means, that the cost of Insurance is constant, it will not change till the client is 100 years old. Here Term Insurance till the age of 100 is used (T-100). The cost of Term Insurance does not change in years and it is calculated as average cost beginning with today till 100 of age. In this situation Universal Insurance will work differently.

The Company charges minimum payment for this Insurance, but there is no Reserve Fund, at the same time the Insurance will work whole life because minimum payment is enough for it. It is important that this minimal payment does not depend on investment interest in future. But if we start paying more than the cost of insurance, all the excess money will be used to work in the market of investments.

We will try to compare Universal Insurance T-100 with another Universal Insurance, which is based on YRT. The minimum cost for Universal Insurance T- 100 is lower, than minimum monthly cost for Universal Insurance with YRT.

People, who have Universal Insurance, based on T- 100, often think, that there is a Reserve Fund inside their Insurance. Unfortunately it is not so. If we pay minimum, the accumulation is so little, that it is practically nothing.

Taking this into account it is important to make the Universal Insurance play the role it should. You start to pay a little more so that there is always a reserve to support the Insurance when necessary. Extra 5-10 dollars per month can provide not only a Reserve Fund, but also an opportunity to stop payments at the age of 65 and still be covered by the Insurance. Because the cost of T-100 Insurance does not change in years, a few thousand dollars will be enough to stop paying for your insurance in future. It is beneficial, because while we make money, we can pay. But when we retire we do not want any insurance programs to bother us with their payments.

How can we calculate the sum of Insurance Amount? It is very important to calculate it accurately, so that the Insurance Contract can play the role it should in covering all the needs of Life Insurance.

The Insurance Contract should cover the needs of today and take into consideration perspectives of the nearest future. Because everything changes and life goes on, the Insurance Amount should be revised from time to time. Some people like Term Insurance (it is cheap), others like permanent plans (prices do not change and money accumulates). But life is many-sided and it is hard to manage it with only one kind of Insurance. Most frequently people use combinations of Term and Permanent Insurance. It provides them with better cover age for less money.

For expert advice on the best policy for your family, please contact our office.