What are some ways to increase your pension?

This article is specifically important to those, planning to retire in the near couple of years.

I constantly meet with retired people and those that plan to soon retire. Most of those planning to retire are not aware as to how their income will work and what amount of support will be received from the government. Many are confused about the amount of their pension and do not fully understand what does and what doesn’t effect their pension.

Some take wrong steps in their retirement:

- Afraid to hold money on an account and keep it “under the mattress”

- Transfer everything to children who will have later pay taxes on gains (whose children would like that?)

- Begin to assign property to children

- sell property

- even divorce to receive a couple hundred extra dollars

There is a lot of misunderstanding and this can have negative effects on health. We all know that worry and stress do not end well.

We want the retirees to feel really well, confident and comfortable in their retirement age. Government will not leave anyone out, but we all understand the phrase – “GOOD LIFE IS BETTER”.

So the goal of this article is – better, confident and comfortable LIFE!

Let’s analyze the following life scenario.

Family, husband and wife, age 62, have a combined income of $75,000. Their residence (townhouse) is worth approximately $600,000. Unfortunately the mortgage is not fully paid yet and the remaining balance is $100,000.

The family really likes their townhouse, and it is close to area where children and grand children are so the family wants to stay in their current residence permanently.

Ongoing costs of owning the property are as follows:

– Maintenance fee $350

– Property tax $280

– Utilities $300

– House insurance $70

– Mortgage payment $750 (amortization period – 13 years)

In total ongoing costs are $1,750 per month.

After tax household income is $4,500 less house expenses – $1,750, remaining living expense for the family is $2,750 per month.

3 years go by and family members now are 65 years old, they are on their way to retirement, total amount of pension from all possible sources is $2,500 per month for both.

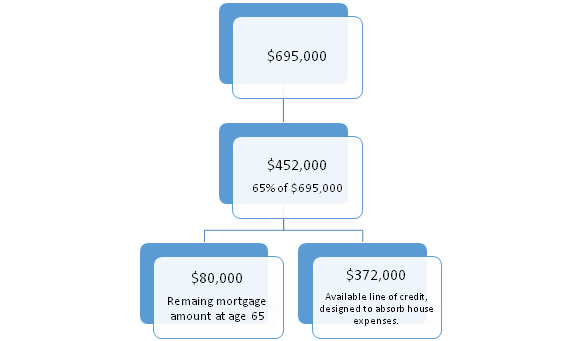

In 3 years value of the house, with a moderate growth of 5%, is at $695,000.

Remaining mortgage amount will be $80,000.

Ongoing property expense are as follows:

– Maintenance fee is now $450

– Property tax – $350

– Utilities increased – $350

– House insurance – $80

– Mortgage payment $770

In total property expenses have increased to $2,000 per month.

What to do if pension is $2,500 and house expenses alone are $2,000?

Let’s look at possible options.

Option 1

Sell the house and buy a nice condo with no mortgage.

Approximate calculations:

$695,000 – 5% (commission) and HST on 5% = $655,000

$655,000 – $80,000 (remaining mortgage) = $575,000

Condo expenses include:

– maintenance fee $750

– property tax $250

Total condo expenses will be $1000 per month.

$2,500 – $1,000 = $1,500

The family is left with $1,500 for everything else. No too much and may end up away from children and grand children, less opportunities to see them often.

Option 2

Continue living in the house they love, obtain home equity line of credit and stop paying for everything associated with the mortgage.

Let’s calculate – age of the couple is 65, townhouse value is $695,000.

Available line of credit.

Line of credit allows to create a situation, in which payment for property is not necessary. The expenses accumulate on the credit line.

| $212 | + $450 | + $350 | + $350 | = $1,362 per month |

| interest on line of credit | maintenance fee | property tax | utilities |

$1,362 x 12 months = $16,344

$16,324 x 20 years = $326,880

In this case we have fully used up the line of credit.

Value of a property, especially on detached homes and town houses has been recently rising at a very high pace. We will be conservative and assume a growth will only be 3% per year.

Even with such a conservative estimate of average growth in 20 years our house (when the retired couple will be at age 85) will be $1,225,000.

$1,255,000 less

- $459,000 ($327,009 including interest for all the years) and

- $234,000 (remaining mortgage $80,000 including interest for all the years)

Will be approximately $555,000

This means, even after such a long time, we still leave inheritance for our loved ones. ($555,000).

What do we get

Today, at 62 years of age, after expenses on the house there is $2,750 left for other expenses.

At retirement age – $2,500, not including costs associated with the property, which we don’t pay.

The family can afford to:

- Go on vacations, as long as health permits

Everybody knows that retirement breaks into 2 stages:

1 stage – when your health is still ok and you are ready to go wherever, as long as there are means.

2 stage – would be happy to travel but the doctor recommends against it and it’s kind of scary

or not even think about traveling – deal with ongoing sicknesses. - Bring grand children on the trips

It feels amazing to be able to help your children and even more so when spend some time with the grand children while there is strength and health, and the children are little. They will grow up and then nothing will convince them to come along. - Make significant gifts to your loved ones while still being around them.

Simple situation – you hear that your grand child wants to change his car, what’s stopping you from gifting him $10,000 or more to buy a car of his dream. You don’t have to burden yourself with interest for this money. Let it accumulate on credit line. You are not taking your house with you into the grave. This money will still go to your family in form of inheritance, it just may be more useful today… (in fact you handing out inheritance during your life)

I think you will agree that giving person is happier than the recipient. - Don’t have to think about tomorrow – what will it take to get through.

All of this allows retirees to feel confident with their financial situation, full of life, useful to children and grand children and be happy.

What else do we need in this life?

We are waiting for you call and meetings.