Credit History

We all, of course, know that having a credit history is very important in order to receive any credit. Majority of us do have a credit history. Great! However, it’s even better to have a good credit history! This is exactly what we shall talk about here.

The credit system has been operational for a long time and today it is very hard to imagine a life without the opportunity of borrowing money. Ok, cars and large house appliances are something you can save the money for, but the house itself… Very few are able to buy the house at once without a loan – mortgage. Thus, disliking the credit system and saying that we will live using only our money is possible (and even good), but knowing what a credit history is, how it works, and having it is absolutely necessary.

Credit history can be thought off as an list of all of our loans, paid off and not paid off, in all financial establishments and the rating based on these loans.

It can be said that the credit history shows, numerically, your willingness to pay back your debts. The smaller the score, the greater the chances that the bank might have difficulties with you in the future, consequently, as the bank tries to reinsure itself, you will be offered a loan with a higher interest rate.

It can be said that the system is right, wrong, or does not reflect all the nuances, yet, this is the system that is used and we have to understand it.

Credit history begins from the moment of receiving your first credit card (banks: Visa, Master Card; or retailers: Canadian Tire, The Bay, etc.). Irrelevant of the type – Visa or store credit card, credit history has already started. Although bank’s cards are preferable, they are more challenging for new immigrants to receive, since having a job is required (the more experience, the better). If you have started working only recently, it is sometimes possible to get a bank’s credit card with an initial security deposit. But this deposit, playing a protective role, usually freezes for 1 to 2 years; in addition, the amount of this deposit is dictated by the bank. For example, for $1,000 of requested credit on the card, it is necessary to deposit $1,500.

Another way is to ask your relatives or friends with enough credit history to act as a co-signer, i.e. to ask someone to accept responsibility along with you, and pay back the loans in case you become insolvent. Those who act as a co-signer for the not-so-close people should be careful, since in case the applicant is unable to pay back the debt, the responsibility will fall on you.

For the purpose of creating a good credit history, it is irrelevant whether initially you have Visa for $500 or $3,000. Important thing is how you handle your financial obligations and your credit rating.

Checking of your credit history, let’s say by the bank, reveals the following information:

- Full name, SIN;

- Current and past place of residence;

- Place of work and position (if the information is up to date);

- All the previous inquiries about your credit history (date, organization’s name, telephone);

- Organizations that you have worked in;

- Names and addresses of your accounts in banks;

- List of your obligations (credit lines, bank cards, retailer cards, loans), limit and balance on all accounts.

Credit history is extremely important in Canada, and that’s why occasionally you need to check it. You can do this in one of two ways: free of charge or for money. Both options have no effect on your score, if you do this yourself.

In Canada there are two bureaus that offer this service – Equifax Credit Information Services Canada (www.equifax.ca) and Trans Union of Canada (www.transunion.ca).

Credit history can be obtained free of charge directly from the office of credit bureau at EQUIFAX CANADA INC. You will need to show up, with documents confirming your identity and a SIN card, to the address: 5700 Yonge St. Food Court Area, Toronto. You can also call Equifax at 1-800-465-7166 or send an inquiry to the address – P.O. Box 190, Postal Station Jean Talon, Montreal, PQ H1S 2Z2.

If you are checking your credit history for free, you can see all your liabilities and how you are paying them back. A free check should be performed at least once a year with the main goal of checking for errors. Unfortunately errors do occur and must be fixed in time. If along with your credit history, you would like to see your score as well, you will have to pay an extra 10 dollars and your credit history will be provided to you with the score. What is the score, it is the number that reflects your willingness to pay back debts and possibility of potential problems with debts this person may have. Additionally, it shows how you are being evaluated by the banks and why you have the score that you do. You will also find recommendations on what you should do to improve your situation.

Financial institutions can commit inaccuracies. For example, upon closure of one Visa credit card and reception of a new one in the same bank, it may be the case that both credit cards will be shown in your credit history along with corresponding debts for both cards. Obviously this is detrimental for the score. You will have to make an inquiry and mistakes will be corrected.

If you do not want to go to credit bureau in person, you can obtain the report online for a fee. Access to, already printed, credit history is allowed for 30 days after you pay for it on the internet. After this, to check your score, you need to pay again to receive the latest information. If you save it on your computer, you can return and analyze it at any time.

If you are checking your credit score online, there are no free checks. Either $15.50 or $23.95 plus tax.

$15.50 + tax – will provide the credit history without the score, same as receiving it for free. In principle, there is no reason to pay for it as the same can be obtained for free.

If you pay a little more, $23.95 + tax, then you will be able to see not only list of debts and their rating, but also your score and explanation – how the bank rates you and why you have this particular score. As well, you get recommendations on what you need to do to change your situation. To check your credit history you need to go to www.equifax.ca and choose the desired option.

Opposite to each line, which represents existing debt, there is a letter R or I along with a number from 0 to 9. These numbers reflect your tendency to pay back your debts.

Number 0 represents approval for the credit – you have just opened an account but have not started using it.

1 – You pay back your balance on time and you have not missed any payments.

2 – Some payments were late by 30 – 60 days. No more than 2 late payments.

3 – Some payments were late by 60 – 90 days. No more than 3 late payments.

4 – Some payments were late by 90 – 120 days. No more than 4 late payments.

5 – Your payments were late by 120 or more days, however, you don’t get the worst score yet.

6 – You make regular payments based on a special agreement with the financial institution, for example, consolidation order or consumer proposal, etc.

7 – Repossession (voluntary or involuntary).

8, 9 – Bad debts, unable to locate, placed for collection, skip.

Letter R represents a credit that is revolving, meaning, you pay it off and are able to use it again. Usually these are credit cards and credit line debts.

Letter I represents a debt with specific amount, which you must pay through fixed monthly instalments. Usually this is a loan on something major, such as a car or a student loan.

As of January 15th, 2015, the credit history will include a letter M. This will be related to mortgages. The credit history will now include information on your property loans, mortgage.

In your Credit History you may see abbreviations (shortened form of a word or phrase), which you need to understand. Explanation you can find here.

If you know you have not missed any deadlines for paying back your debts, then your responsibility is to check for errors, and it is satisfactory to obtain a free credit history.

However, upon credit lending, the main object of interest for financial institutions is the score. Higher score is better. The score fluctuates between 300 and 900.

If your score is:

300 – 540 – credit history is very bad and no one will be giving you money.

540 – 580 – this is a bad credit score but obtaining a mortgage is possible, not with large banks, but with “Lender B”. This banks require a large down payment.

580 – 620 – obtaining a mortgage is possible, even with a “Lender A”. The important condition here to consider is the down payment. The larger down payment will be preferred.

620 – 650 – of course, this is below the average, but the banks are willing to accept this. It is best to have a down payment higher than 5%, but even a 5% down payment is an option.

650 – 680 – mortgage with 5% down payment will be offered by any bank.

Over 680 – you are welcome with any down payment, even without it, but only for those with full time employment.

Over 700 – many banks now prefer to see such score for self-employed people with a not so high income.

Do you know your credit score? Of course, it is good to know, prior to applying for a credit.

Important to remember, all applications for credit cards, loans and credit lines get recorded in your credit history. Therefore, if you have been declined a few times, it is best to leave it for a few months, instead of trying over and over again. Remember, each entrance in your credit history may lower your total score, which is very undesirable.

For those who feel there might be problems with their credit history (many debts, turned down for a credit, etc.), it’s better to check your score on the internet prior to asking for credit. With the credit history in your hands you can consult a specialist regarding what ever problems are present and ways to avoid them.

Let’s say, for example, that you have checked your credit history and want to know what influences the score and how you can increase it. Furthermore, you would like to know how to do this as soon as possible.

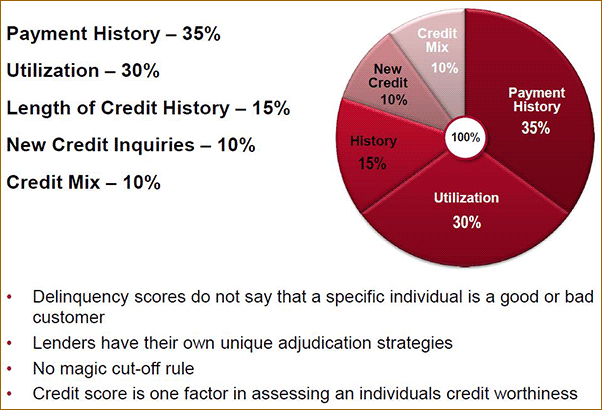

The following 5 points affect the credit history in major ways:

- Your past. The way you used your credit in the past and how readily you followed the deadlines. Level of influence – 35%.

- Amount of debt you have – 30%.

- Amount of time you have had a credit history – 15%.

- Number of requests for credit, in comparison to the number of times the credit was obtained – 10%.

- Credits from various financial institutions – 10%.

Diagram by Equifax as of January 8, 2015

Lets take a look at this information with more detail.

Your past.

Obviously, information about your payments on debts and how often you missed the deadlines is very important. If the payment is a little bit past the deadline, usually there are no severe consequences. Large banks do not punish for one late payment, however smaller banks sometimes turn to credit bureau upon the end of the 30 day period after the deadline. Therefore, missed or partial payments drag your score down. If you happen to payback above the minimum required amount, that’s good, however, if you go over the maximum allowed credit in any month, it is very bad and seriously ruins your credit history. If you are to payback your debt in full on your credit card – great! Lets image a scenario where a person has a credit card with attractive incentive – the more money is spend the more certain kind of points the card holder gets. The person tried to use the card more frequently, spends the credit almost to the maximum and repays the collected debt.Everything is good, yet things can be improved further. The financial institution, with which you have your credit card, sends you a statement on a specific date of the month, and provides you with a 20-day period for paying back your debt. You pay it, but the credit bureau receives information that such-and-such amount if spent by you – remember, a large debt lowers your score? It works out that every month you are living with using the maximum allowed limit. At the very least, that is the perception, because the credit bureau doesn’t know that you paid and just reused it. The information they receive is that from month to month you are at your limit. It’s good that you pay the balance right away, as soon as you receive the statement, this way you avoid paying interest on your transactions and you collect points, however, if you pay your credit card debt prior to receiving the statement, or close to balance, the credit bureau will register a smaller balance and this will better your credit history. It’s a win-win – receive points and maintain good credit history.

Let’s take a look at some examples:

- A person has two credit cards with 19% interest and has spent half of the maximum $10,000 credit available on each card. Let’s say, there is an offer from a third-party company to consolidate debts on $10,000 with 5.99% over a 6-month period. This, now happy, person transfers all $10,000 into the new card and, correspondingly, spends all the given $10,000. He/she of course saves on the percentages, but the credit history is worse off, since 100% of the credit is spent. Be attentive and do not exceed 90% of your limit.

- Another example. Someone has 5 credit cards with different interest rates and with the sum total of $50,000. $20,000 is spent – 40% of the total debt. The owner of the credit cards decides to terminate 2 cards with total sum of $20,000, so that there is no temptation. What is the final outcome? The debt balance, in comparison to possible credit amount, shifts from 40% to 68% and will deteriorate your credit history.

The length of time you have had your credit history.

Credit history of less than 2 years is considered immature, older than 2 years on the other hand is much better. For example, it is necessary to have a credit history for longer than 2 years if one wishes to buy property without a down payment. Meaning, one should try to acquire any credits as soon as possible. For example, retailer’s credit card is the easiest to get, you can start with that, thus starting your credit history. Or you can get secured credit card, that is, to place some monetary amount on a special account. That way, both, new immigrants and a person who recently went bankrupt can start a credit history. For those who are self-employed, a minimum 2-year-old credit history is required.

Number of requests as compared to the number of received credits.

At one time or another, all of us go to a financial institution for some sort of a loan. As most understand, every enquiry, potentially has an effect on our credit history and reduces our score. Requesting a loan for a mortgage or an auto loan works different. If you do look for a loan under 1 of these condition, inquiries made within 14 days are counted as one inquiry.

Credits from different financial institutions.

We all have different credits with various financial institutions, but these credits influence the credit history differently. Credit cards from large banks are more desirable. Retail cards are significantly less important for credit history evaluation and thus, if are not used, should be closed.

And, of course, various types of problems with paying back debts, collection agency, judgment, consumer proposal, bankruptcy, and etc, all have significant, negative influence on the credit history. Situations may vary and you are better off fighting unjust payments, than simply stopping the payments and doing nothing. That is not the answer, since you are hurting only your self.

This section was created using the brochure from Financial Consumer Agency of Canada – “Understanding your Credit Report and Credit Score”.